What to do when corona affects your money

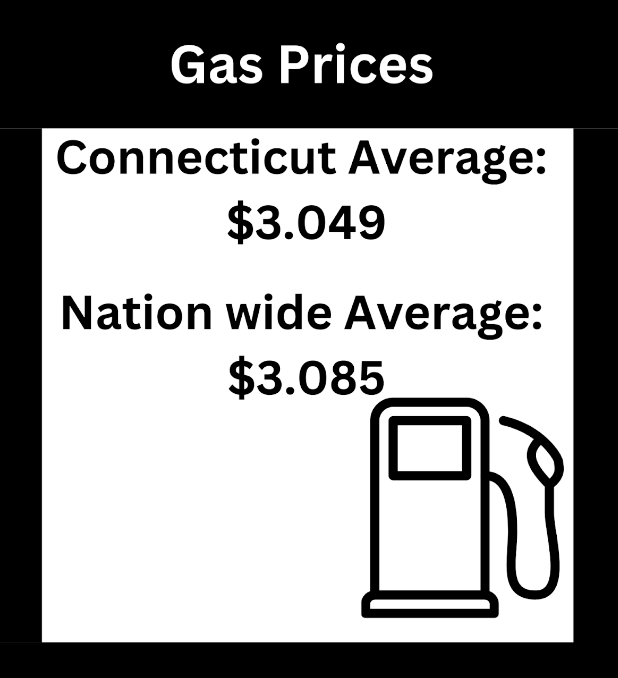

The stock market plummets and rises during the midst of the coronavirus pandemic

Starting a few weeks ago, the stock market began rapidly plummeting in the midst of the coronavirus pandemic. Headlines across the world read how the stock market has not been this volatile since the downfall in 1987 and how Dow Jones has fallen thousands of points. In simple terms, people are freaking out.

When I walked into my personal finance class the day after the initial shock, I was blown away by the number of students who were concerned about their own money and how at risk they felt. Staples students and parents contribute their own money and savings into these stocks and the downfall of the market is sometimes too much to handle for them. My classmates told me how they were going to pull their money out of all their stocks, as they were concerned that what was coming was the “next 2008 recession.”

I’d urge students and parents to keep their money in the stock market, although not invest any more money, as it will go up and prices of stocks are currently extremely low to buy.

The initial downfall of the economy and stock market was truly shocking. As days passed, the stock market fell thousands of points and insane percentages, as ABC comments on it, on Thursday, the Dow Jones Industrial Average lost more than 2,350 points, which is about 10%. The day before it fell 1,400 points and investor anxiety pushed towards a market similar to the 2008 recession for the first time ever.

The news of the downfall in the stock market brought shock to people across the world. People titled it “the next 2008” and that the coronavirus had changed the stock market once and for all. As a Washington Post article explains, people are assuming the period of extraordinary volatility is not over, and until investors see more calm in the market or a change in the coronavirus, a recovery in the markets is unlikely.

I sense that the pattern of the stock market will not be an outrageous constant downfall yet, and will eventually steady out. Things are crazy right now with the virus and companies closing, although I do not think people should pull their money out of stocks right now.

As of March 15, just a few days later, the stock markets are back up and Dow Jones is up 9.36%. But on March 18, the stock market was once again down huge percentage points and specifically, Dow Jones closed below 20,000 total points for the first time ever since February 2017.

The stock market is not at a constant plummet, yet is back and forth every day, switching back from positive to negative percentages. Although this might sound intimidating, this is perfectly normal and what a stock market should look like.

Fred Egler, a certified financial planner at Betterment explains that, obviously, no one wants to see their stocks lose value, although, these periods of risk are part of investing. No one is really certain when the market will have a good day, and having bad days in the market can be detrimental to building wealth in stocks.

That’s why my advice is to not freak out. Keep your stocks in the stock market because every day brings something new and try to keep in mind that the economy is a rollercoaster right now. Having risk and volatility is never fun in stocks, although that is what they are all about.