“Tampon tax” places an unfair burden on women

Getting my period was, quite literally, the worst thing that had ever happened to me. It was mortifying, to say the least. I hid in my room until my mom came upstairs and forced me to tell her why I was so upset. She ran out to CVS, and when she came back with a box, I hid under the covers of my bed. I didn’t think this was supposed to happen to me. Not yet, at least. I am lucky to have a mom who was understanding and a family that can afford my necessities. But many girls do not have these privileges. For low income families, feminine hygiene products are not affordable, and not considered a top priority.

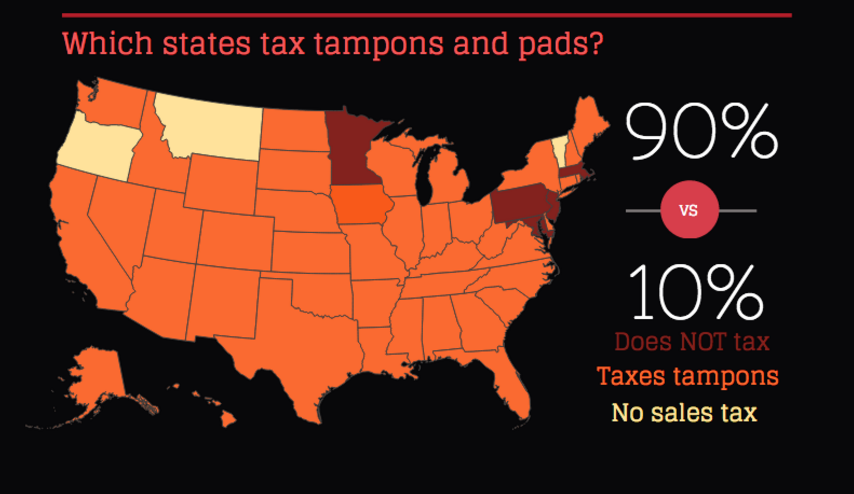

Efforts to eliminate the ‘tampon tax’ are not new. Canada’s tax on tampons was lifted over the summer, and Maryland, Massachusetts, Pennsylvania, Minnesota, and New Jersey make up the 10 percent of states without a tampon tax. The other 90% of states either do not have a sales tax or don’t consider tampons and pads a ‘necessity.’

In January, California Assemblywoman Cristina Garcia introduced a bill that would exempt tampons and pads from sales tax in California. She acknowledges that that “women have no choice but to buy these products, so the economic effect is only felt by women. […] You can’t just ignore your period.” She authored the new proposal with fellow assemblywoman, Ling Ling Chang, a Republican, proving that the tampon tax transcends partisan lines and affects women of every demographic.

In 1989, Gloria Steinem, journalist and feminist activist wrote that if men got periods, tampons and pads would be “federally funded and free” and that there would be “gifts” and “religious ceremonies” to commemorate the beginning of their cycles. Tampons and pads are necessities, and should be taxed as such. Medical supplies, most groceries, and prescription pills are already exempt from sales taxes, and there’s no reason why tampons and pads shouldn’t, too.

To say Lulu Stracher ‘17 has writing in her blood would be an understatement. Being the daughter of two published authors and the sister of Simon Stracher,...