On Monday, Nov. 17, the yellow Snapchat icon, familiar to many student smart phones, declared a notification. However, eager openers surprisingly found no friendly selfie – rather a message from “teamsnapchat” themselves, announcing the new ability to exchange money through “snapcash.”

According to Snapchat’s official site, Snapcash allows users to type a dollar amount into a chat window and immediately transfer money to friends’ bank accounts.

Snapchat, originally used to send 1-10 second photo messages, has long metamorphosized since its release in 2012, adding stories, messages, video chat, filters and artwork.

But, despite common updates, the dazzling video announcing Snapcash struck students and faculty alike as vague and potentially risky. Information explaining the monetary exchange and existence of fees, risks or restrictions was lacking.

Personal finance teacher Stacey Delmhorst was even prompted to discuss Snapcash with her class. Delmhorst asked students what questions they thought she would have about the app.

Students Ben Rogers ’15, Mikaela Dedona ’15 and Daniel Williams ’15 called out, “how fast is money transferred?”, “where does the money go?” and “is there a transfer fee?” respectively.

Delmhorst etched each suggestion onto the blackboard, yellow chalk tapping along. Then, she circled the phrases “security,” “fees,” “debit or credit,” and “cancellations.” These denoted her biggest concerns.

“It’s solely debit,” Delmhorst said. “You cannot use your credit card. That was huge red flag number one for me. Credit cards offer protection against fraud; debit offers none. The minute I heard it was debit only, I was out.”

The class discussed the possibility of someone stealing a phone that had debit information stored, with only the security of a card’s CVC pin offered.

“It’s very easy to be irresponsible,” Agim Trdevaj ’15 said.

However, students identified that apps like CitBank and Venmo offer similar cash transfer, but with more credible protection.

“It’s a really good idea, but there are already other apps and companies that do it a lot better,” James Stanley ’15 said.

Cole Crawford ’15 proposed a reason for finances to move towards popular teen social media.

“It’s only kids our age who tend to be irresponsible with money. They think adults who are smart with money wouldn’t even get the app, but kids would get it with the incentive of using it,” he said.

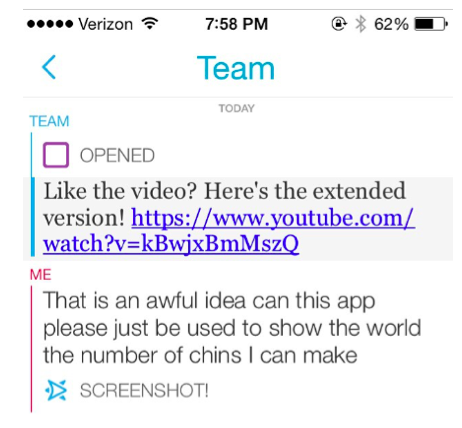

Others even denounce Snapcash for non-financial reasons. Claire Smith ’15 was so horrified at the video that she felt compelled to reply and post the message on her Instagram account.

“That is an awful idea. Can this app please just be used to show the world the number of chins I make,” Smith’s post lamented, garnering nearly 100 likes

Whether for financial worry or frustration at excessive updates, Smith sums up the general consensus that Snapcash is simply unnecessary.

“Keep the app for double chins and ‘I woke up like this’ selfies please,” she said.